Rsu stock tax calculator

It assumes that you earn a salary of 150000 receive RSUs of 50000 and are liable for paying employers national. Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer.

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

The of shares vesting x price of shares Income taxed in the current year.

. The amount used to calculate your income taxes Stock Plan. Value of the unvested RSUs before taxes. 24000 120200 Note that on 122019 youre 0 vested in the RSUs.

Avoid Taxes on RSUs Tip 1 - Max Out Your 401 k on a Pre-tax Basis. If you live in a state where you need to pay state. Lets say youre subject to a 25year vesting schedule.

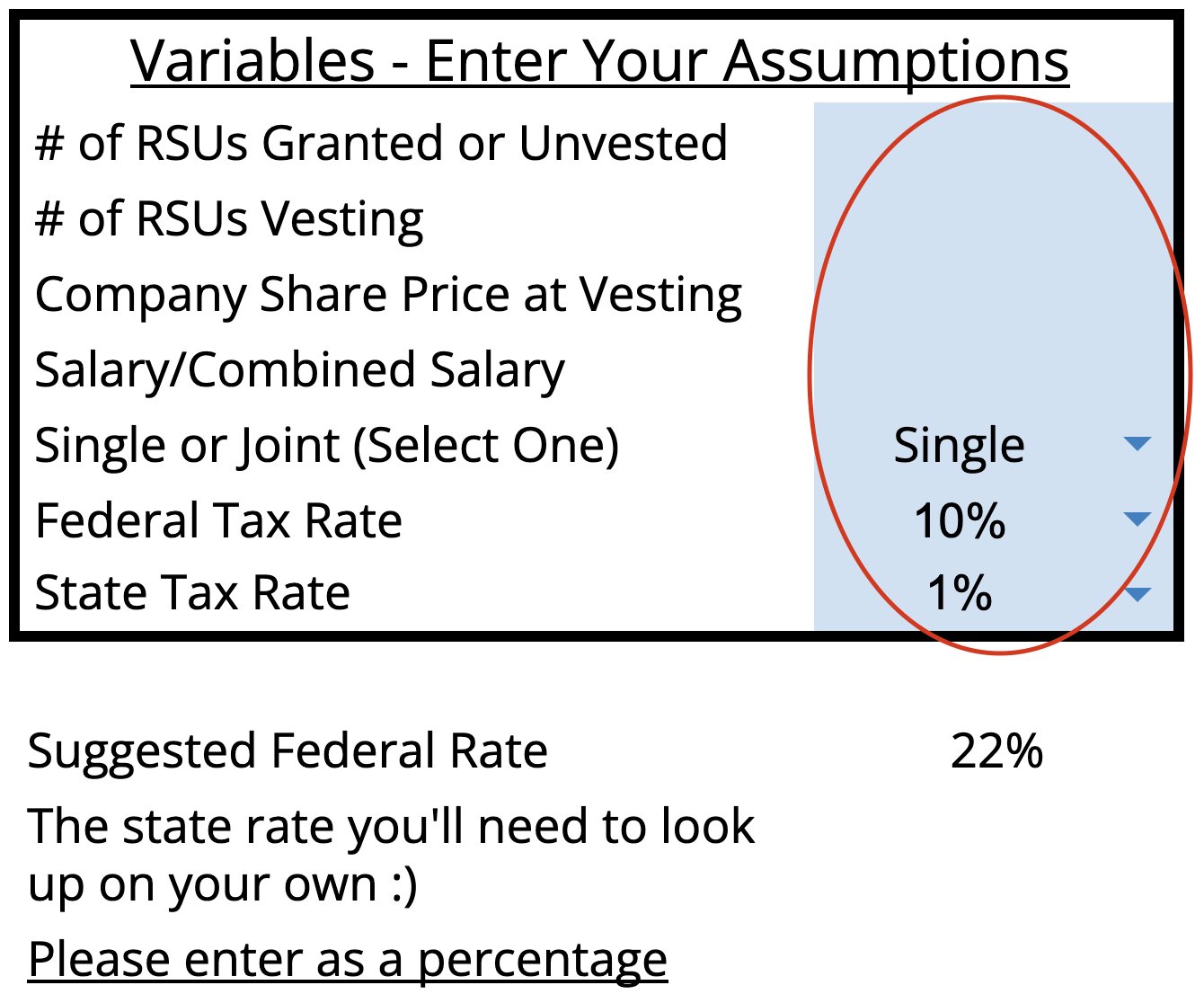

Basic Info for RSU Calculator Shares Granted Vesting Schedule Hypothetical Future Value Per Share Marginal Federal Tax Rate You can use the 2020 brackets below to estimate your tax. We strongly encourage you to consult a professional tax advisor for advice specific to your tax Fed Taxable Gross. For example if you are issued 10000 worth of RSUs as part of your compensation package you will pay ordinary income tax on 10000.

The market price at the time the shares are granted is 20. You will be paid 30. The first way to avoid taxes on RSUs is to put additional money into your 401 k.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. This online calculator allows you to estimate both federal and state taxes due to an IPO or vested RSUs and is especially useful as it takes into account capital gains deductions and existing tax. RSUs are a form of compensation offered by a firm to an employee in the form of company shares.

You are granted 10000 RSUs shares of company stock that vest at a rate of 25 a year. Vesting after making over 137700. The below example calculates the tax you will pay when your RSUs vest.

Vesting after Social Security max. Ad Equity Compensation Plans that Extend Borders and Possibilities for Your Business. With Equity Edge Online and Shareworks We Provide End-to-End Equity Plan Solutions.

Ad Thinking of switching from stock options to RSUs restricted stock options. Enter details of your most recent RSU grant your companys vesting schedule and some. Feb 08 2022 amazons rsus currently vest 5 after the first year 15 after the second and then 20 every six months for the remaining two years.

Compare how the total payout may change between options and RSUs. Vesting after Medicare Surtax max. If held beyond the vesting date the RSU tax when shares.

On this page is a Restricted Stock Unit Projection calculator or RSU calculator. RSUs are generally subject to a vesting schedule meaning the stock does not. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

If you choose to hold. Let us understand tcs tax. Vesting after making over.

RSU tax at vesting date is.

Rsu Taxes Explained 4 Tax Strategies For 2022

Blog Upstart Wealth

U9f7vmjpnzvc8m

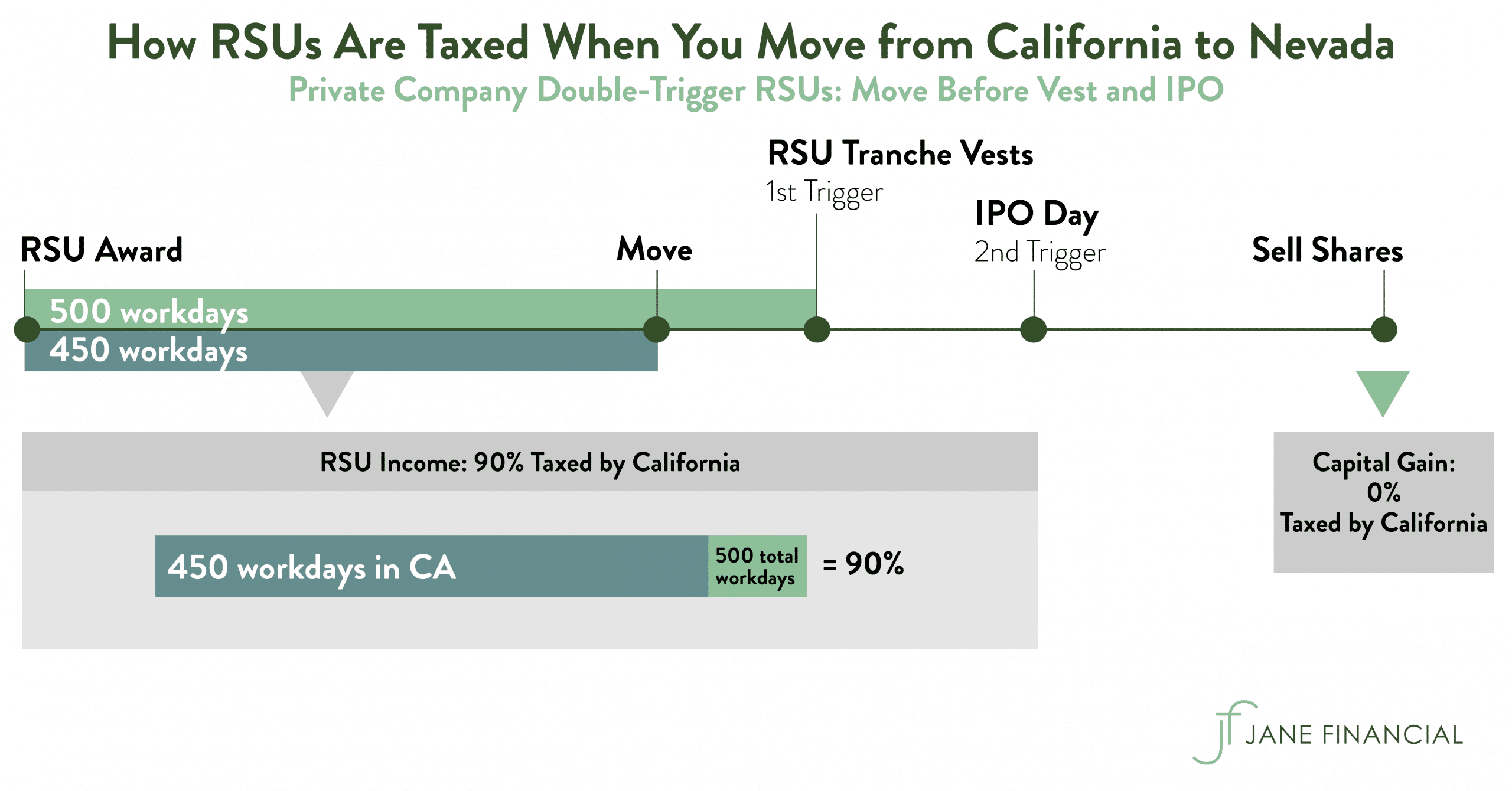

Restricted Stock Units Jane Financial

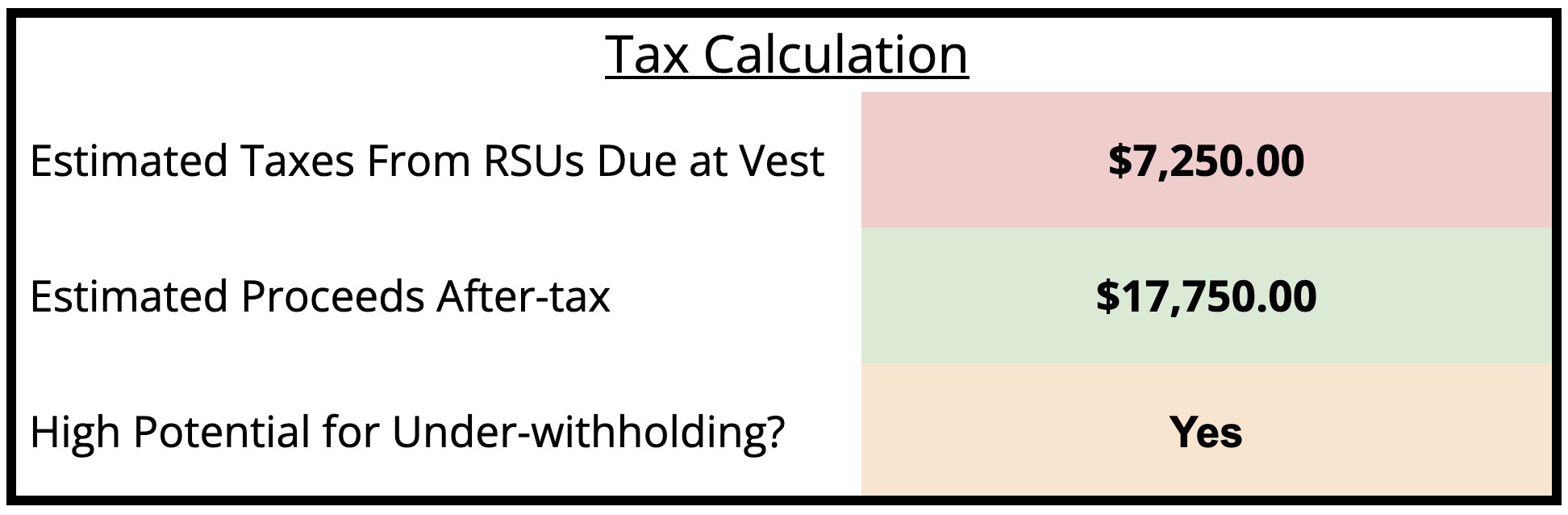

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Restricted Stock Units Jane Financial

Rsu Calculator Projecting Your Grant S Future Value

When Do I Owe Taxes On Rsus Equity Ftw

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Rsu And Taxes Restricted Stock Tax Implications

Rsu Taxes Explained 4 Tax Strategies For 2022

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

Rsu Taxes Explained 4 Tax Strategies For 2022

Restricted Stock Unit Rsu Tax Calculator Equity Ftw